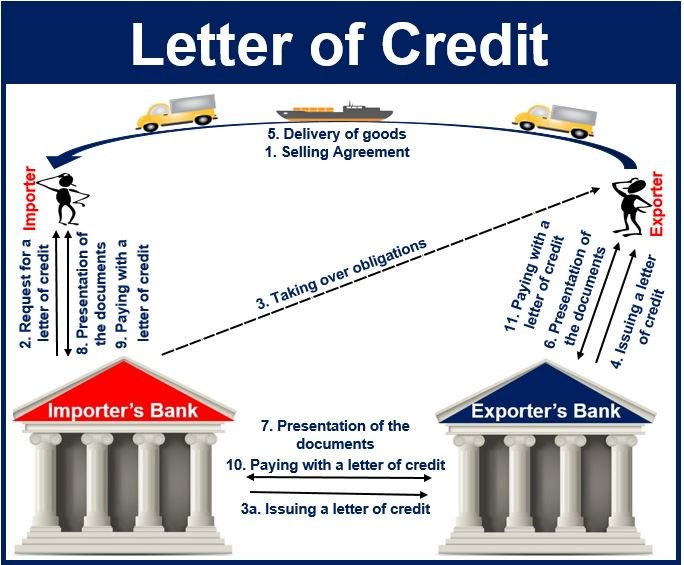

In the international trade, letters of credit (LCs) play a crucial role in ensuring secure transactions between buyers and sellers. Two widely used types of LCs are “LC at Sight” and “Usance LC.” Though they serve the same fundamental purpose of guaranteeing payment, their terms regarding the timing of payment differ significantly. This article provides an in-depth comparison of LC at Sight and Usance LC, highlighting their key features, advantages, disadvantages, and practical applications.

LC at Sight

Definition: An LC at Sight is a type of letter of credit that mandates immediate payment to the seller upon presentation of the required documents to the issuing or confirming bank. Once the bank verifies that the documents comply with the LC terms, it releases the payment without delay.

Key Features:

- Immediate Payment: Payment is processed as soon as the bank confirms that the presented documents meet the LC requirements.

- Security: Both parties are assured that the seller will receive payment promptly after fulfilling their contractual obligations.

- Speed: Typically, payment is made within a few working days after document submission, ensuring a quick transaction process.

Advantages:

- For Sellers: Ensures prompt payment, enhancing cash flow and reducing the risk of non-payment.

- For Buyers: Guarantees that payment will only be made once the goods are shipped and the necessary documents are presented, ensuring that the seller has met their obligations.

Disadvantages:

- For Sellers: Requires careful preparation and accurate submission of documents to avoid discrepancies that could delay payment.

- For Buyers: Immediate payment can strain cash flow, especially if the goods are received much later.

Use Cases: LC at Sight is often used in transactions where the seller requires immediate payment upon shipment of goods. This type of LC is ideal for sellers who need to maintain a steady cash flow and cannot afford to wait for an extended period for payment. It is also suitable in situations where the buyer and seller are new trading partners and trust levels are not yet established.

Usance LC

Definition: A Usance LC, also known as a deferred payment LC, is a type of letter of credit where the payment is made at a future date after the presentation of the required documents. The payment term is usually defined as a specific number of days (e.g., 30, 60, 90, or 180 days) after the date of the bill of lading or the presentation of documents.

Key Features:

- Deferred Payment: The seller receives payment at a future date as specified in the LC terms, allowing a grace period for the buyer.

- Credit Terms: The buyer enjoys a credit period, providing time to receive and potentially sell the goods before payment is due.

- Documentation: Similar to an LC at Sight, the seller must present the necessary documents to initiate the deferred payment process.

Advantages:

- For Sellers: Provides a guarantee of future payment, allowing for better financial planning and risk management.

- For Buyers: Offers a grace period to arrange for funds, improving liquidity and cash flow management.

Disadvantages:

- For Sellers: Payment is delayed, which can impact cash flow and may require financing to cover the gap.

- For Buyers: Must ensure they have sufficient funds available when the payment is due, which requires careful financial planning.

Use Cases: Usance LC is commonly used in transactions where the buyer needs time to inspect, process, or sell the goods before making the payment. It is ideal for buyers who need a grace period to manage their finances and for sellers who are confident in the buyer’s ability to pay at a later date. This type of LC is also beneficial in markets where extended payment terms are a standard practice.

Key Differences Between LC at Sight and Usance LC

| Feature | LC at Sight | Usance LC |

|---|---|---|

| Payment Timing | Immediate upon presentation of documents | Deferred to a future date specified in the LC |

| Cash Flow | Immediate improvement for sellers | Delayed impact, providing a credit period |

| Credit Terms | No credit terms; payment is made right away | Credit terms provided to the buyer |

| Usage Scenario | Preferred when sellers need quick payment | Preferred when buyers need time to arrange funds |

| Risk | Lower risk for sellers due to immediate payment | Higher risk for sellers due to deferred payment |

Choosing Between LC at Sight and Usance LC

Payment Timing

- LC at Sight: Payment is made immediately upon presentation of the required documents.

- Usance LC: Payment is deferred to a future date specified in the LC terms, typically ranging from 30 to 180 days after the presentation of documents.

Impact on Cash Flow

- LC at Sight: Provides immediate improvement in cash flow for sellers but requires buyers to make immediate payment.

- Usance LC: Delays cash flow for sellers but offers buyers a grace period, improving their liquidity and cash flow management.

Credit Terms

- LC at Sight: No credit terms are extended; payment is made promptly.

- Usance LC: Credit terms are extended to the buyer, allowing them time to arrange for payment.

Usage Scenarios

- LC at Sight: Preferred when sellers need quick payment, and buyers are able to make immediate payment.

- Usance LC: Preferred when buyers need time to arrange funds or when extended payment terms are a standard practice in the industry.

Risk Considerations

- LC at Sight: Lower risk for sellers due to immediate payment; higher liquidity requirements for buyers.

- Usance LC: Higher risk for sellers due to delayed payment; lower immediate liquidity requirements for buyers.

Practical Tips for Choosing Between LC at Sight and Usance LC

When deciding between an LC at Sight and a Usance LC, consider the following factors:

- Cash Flow Needs: Assess the cash flow requirements of both the buyer and the seller. If the seller needs immediate funds, an LC at Sight is more suitable. If the buyer needs time to manage cash flow, a Usance LC is preferable.

- Trust Level: Evaluate the level of trust between the trading partners. Usance LCs are often used in established relationships where there is confidence in the buyer’s ability to pay at a later date.

- Cost of Financing: Consider the cost of financing for both parties. Sellers might need to seek financing if payment is deferred, which could add to the cost.

- Market Practices: Take into account the standard payment practices in the industry. Some industries may commonly use Usance LCs due to longer supply chains or sales cycles.

- Document Preparation: Ensure that both parties are capable of preparing and verifying the required documents accurately and promptly to avoid delays in payment.

Conclusion

Both LC at Sight and Usance LC are vital tools in international trade, offering distinct advantages and addressing different needs. An LC at Sight provides immediate payment security for sellers and ensures that buyers make prompt payment upon shipment. Conversely, a Usance LC offers buyers the flexibility of deferred payment, which can help manage cash flow and align payment with revenue generation. By understanding these differences and carefully considering their specific trade requirements, businesses can choose the most appropriate type of letter of credit to facilitate secure and efficient transactions in the global market.