In the fast-paced world of international trade, security and reliability are paramount. One financial instrument that offers these qualities is the “LC at sight” or “Letter of Credit at Sight.” This article will provide an in-depth look at what an LC at sight is, how it works, its advantages, and how it can benefit businesses engaged in global commerce.

What is an LC at Sight?

A Letter of Credit at Sight is a type of letter of credit that guarantees immediate payment to the seller upon the presentation of the required documents. This payment mechanism is particularly useful in international trade, where parties often operate in different jurisdictions and may not have established trust.

How Does an LC at Sight Work?

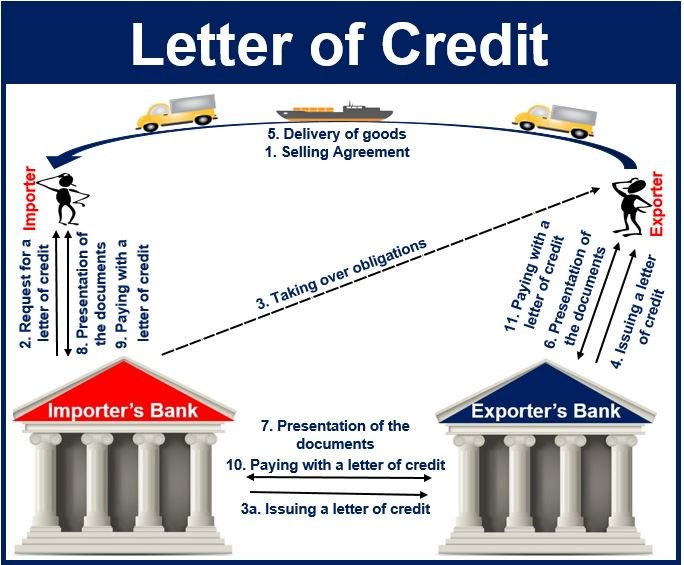

The process of an LC at sight involves several key steps:

- Agreement: The buyer and seller agree to use an LC at sight as their method of payment. This agreement is usually part of the sales contract.

- Issuance: The buyer requests their bank (the issuing bank) to issue a letter of credit in favor of the seller.

- Shipment: The seller ships the goods as per the agreement and prepares the necessary documents, such as the bill of lading, commercial invoice, and packing list.

- Presentation: The seller submits these documents to their bank (the negotiating or confirming bank), which then forwards them to the issuing bank.

- Verification: The issuing bank reviews the documents to ensure they comply with the terms specified in the letter of credit.

- Payment: Once the documents are verified and found to be in order, the issuing bank makes an immediate payment to the seller, usually within a few days.

Example of an LC at Sight:

In this case, both parties agree to use the ‘LC at Sight’ payment technique to avoid risk. All terms and conditions governing the trade agreement are accepted by the parties. Business A requests that its bank, a reputable US financial institution, issue a Letter of Credit at Sight to the exporter – Business B, which is located in India. All of the agreed-upon terms and conditions should be included in the LC.

The document is issued by the importer’s bank and delivered to the exporter’s bank in India. The exporter then receives the LC from the bank and begins the production process after reviewing the paperwork. When the goods are ready, the supplier ships them and delivers the packing bill and Bill of Lading to the Indian bank for review. The bank then sends the paperwork to the importer’s bank after checking for any inconsistencies.

After reviewing the documentation, the importer’s bank requests payment of LC amount to obtain the document. The importer, Business A, cannot obtain the documents without paying the LC amount since the bank has issued a Letter of Credit at Sight. Without it, the importer also cannot receive the goods that the exporter has delivered. The bank transfers the funds to the designated bank when the importer pays the amount and gets the necessary paperwork.

Key Features of LC at Sight

- Immediate Payment: Payment is made promptly upon presentation of compliant documents.

- Security: Provides a secure method of payment for both buyers and sellers.

- Documentary Compliance: Payment is contingent on the presentation of specific documents, ensuring that the seller fulfills their contractual obligations.

Advantages of LC at Sight

For Sellers

- Guaranteed Payment: Sellers receive payment as soon as the required documents are presented and verified. This reduces the risk of non-payment.

- Improved Cash Flow: Immediate payment helps sellers maintain a healthy cash flow, which is crucial for business operations.

- Risk Mitigation: Minimizes the risk of payment default by the buyer, especially in international transactions.

For Buyers

- Assurance of Shipment: Ensures that payment is made only when the seller provides proof of shipment, protecting the buyer from fraudulent activities.

- Negotiation Leverage: Buyers can negotiate better terms knowing that the seller will be paid only upon fulfilling their obligations.

- Reputation Management: Using an LC at sight can enhance a buyer’s reputation as a reliable and trustworthy trading partner.

Disadvantages of LC at Sight

While LC at sight offers numerous benefits, it also has some drawbacks:

- Cost: Issuing and processing an LC at sight involves various fees, including bank charges, which can be significant.

- Complexity: The process requires meticulous documentation and strict adherence to the terms of the letter of credit, which can be cumbersome and time-consuming.

- Potential Delays: Any discrepancies in the documents can lead to delays in payment, impacting the seller’s cash flow.

Practical Tips for Using LC at Sight

To maximize the benefits of LC at sight, consider the following tips:

- Clear Terms: Ensure that the terms and conditions of the letter of credit are clear and unambiguous to avoid any misunderstandings or disputes.

- Accurate Documentation: Pay close attention to the preparation of documents. Even minor errors can lead to delays or non-payment.

- Bank Selection: Choose reputable banks with experience in handling letters of credit to ensure smooth and efficient processing.

- Communication: Maintain open communication with all parties involved, including your bank, to promptly address any issues that may arise.

Common Documents Required for LC at Sight

The specific documents required can vary depending on the agreement, but typically include:

- Bill of Lading: Proof of shipment and receipt of goods.

- Commercial Invoice: Detailed invoice specifying the goods, quantities, and prices.

- Packing List: Itemized list of the goods being shipped.

- Insurance Certificate: Proof of insurance coverage for the shipment.

- Certificate of Origin: Document stating the origin of the goods.

LC at Sight vs. Other Types of Letters of Credit

LC at Sight vs. Deferred Payment LC

- LC at Sight: Payment is made immediately upon presentation of documents.

- Deferred Payment LC: Payment is made at a future date specified in the letter of credit, providing the buyer with a grace period.

LC at Sight vs. Standby LC

- LC at Sight: Used for actual trade transactions, guaranteeing payment for shipped goods.

- Standby LC: Acts as a secondary payment mechanism, usually invoked only if the buyer fails to make the payment as agreed.

Types of letters of credit

1. Commercial letter of credit

2. Traveller’s letter of credit

3. Confirmed letter of credit

4. Standby letter of credit

5. Sight letter of credit

6. Acceptance or timed letter of credit

7. Revocable letter of credit

8. Irrevocable letter of credit

9. Back-to-back letter of credit

10. Transferable letter of credit

11. Restricted letter of credit

12. Revolving letter of credit

Conclusion

An LC at sight is a powerful tool in international trade, providing security and reliability for both buyers and sellers. By understanding its workings, advantages, and potential drawbacks, businesses can effectively leverage this financial instrument to facilitate smoother and safer transactions. Whether you are a seasoned trader or new to the global market, incorporating LC at sight into your payment strategies can help mitigate risks and enhance your trade operations.

In a world where trust and security are paramount, an LC at sight offers a robust solution, ensuring that your international transactions are conducted with confidence and peace of mind.