What are the differences between Incoterms 2010 and Incoterms 2020?

The main explanations of Incoterms 2020 have remained the same, with a few key updates and changes. The main change includes a new DPU term replacing DAT, along with other changes to Incoterms as below. It’s imperative that all parties involved in global trade understand these updates and how they may affect your supply chain.

New Incoterm DPU Replaces DAT

The previous Incoterm DAT (Delivered at Terminal) is now called DPU (Delivered at Place Unloaded. It was decided to change the term to DPU to remove confusion that arose in the past. In the past, DAT required ‘Delivery at Terminal (unloaded)’, however the word “terminal” caused confusion. The new term DPU (Delivery at Place Unloaded) covers ‘any place, whether covered or not’.

Different level of insurance cover between CIF and CIP

CIF and CIP are the only two Incoterms that require the seller to purchase insurance in the buyer’s name. Under Incoterms 2010 the insurance cover for both CIF and CIP was required under Institute Cargo Clause C. Under the new Incoterms 2020, CIP requires insurance cover complying with Institute Cargo Clause A. Clause A covers a more comprehensive level of insurance which is usually suitable for manufactured goods, where Clause C would likely apply to commodities.

In summary:

- CIF remains the same, it requires ‘Institute Cargo Clause C’ insurance cover – Number of listed risks, subject to itemized exclusions.

- CIP now requires an upgraded ‘Institute Cargo Clause A’ insurance cover – All risk, subject to itemized exclusions.

Updated Costs and Listings

Costs became quite a problem with Incoterms 2010 with some parties. In some cases carriers were changing their pricing so sellers were often faced with new back charged terminal handling charges. Incoterms 2020 now provides much more detail around costs and now appear under the A9/B9 sections of the rule. This clearly states which costs are allocated to each party.

Increased Security Requirements, Allocations and Costs

In a world with increasing security requirements, the Incoterms 2020 rules now provide more detail around security allocations and necessary costs. For each Incoterm rule, the security allocations have been added to A4/A7 and the associated costs have been added to A9/B9.

Buyer’s and Seller’s Own Transport

Under Incoterms 2010 it was assumed that all transport would be undertaken by a third party transport provider. Updates to Incoterms 2020 allows for the provision for the buyer or seller’s own means of transport. This recognizes that some buyers and sellers are using their own methods of transport, including trucks or planes to get goods delivered.

- This allows for the buyer’s own means of transport under the FCA rule

- This allows for the seller’s own means of transport under DAP, DPU and DDP.

FCA, FOB and the Bill of Lading Process

Updates were made to the previous Incoterms 2010 to encourage exporters of containerized goods to use the FCA Incoterm. In reality most parties were still using FOB when they should have been using FCA. This is because even experienced sellers still wanted to use FOB because they wanted the contract to be under a Letter of Credit.

CPT (Carriage Paid To)

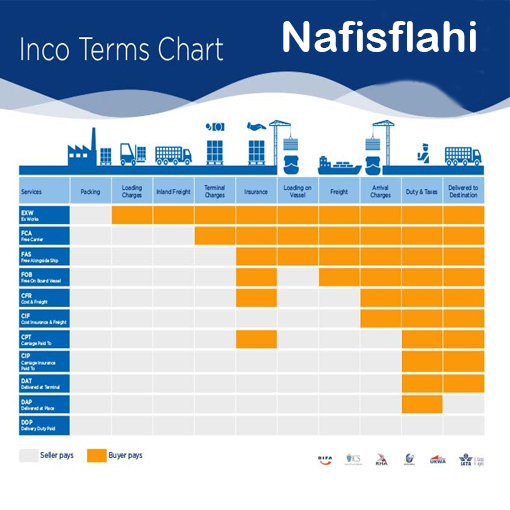

CPT shipping terms indicate that the seller bears all costs of transporting goods to the port of discharge. The seller’s responsibility for the goods, however, ends on delivery to the carrier at a named place. CPT can be used for all modes of transports including air and sea.

CIP (Carriage and Insurance Paid)

CIP terms indicate the same seller responsibilities as CPT (cost to the port of discharge, responsibility to delivery to carrier) but with the additional inclusion of maritime insurance.

CFR (Cost and Freight)

With CFR terms the seller’s invoice will include the cost of the goods plus the cost of transporting the goods to the port of discharge (not including local charges). Although CFR terms can appear to be a good option, the buyer has little control over the shipping process and the associated costs.

CIF (Cost, Insurance and Freight)

The same shipping terms as CFR, plus a marine insurance policy also paid by the seller.

CIF Felixstowe (Cost, Insurance and Freight Felixstowe)

CIF terms on the basis of the destination port being Felixstowe UK. As with CFR and CIF, these terms can be less favourable for buyers, meaning less control and unexpected fees.

DAT (Delivered at Terminal)

With DAT terms the seller is responsible for delivery to the named terminal at the destination port, and unloading ready for buyer/carrier collection – after which, the responsibility for the goods passes to the buyer. The seller is responsible for the goods export customs clearance. The buyer is responsible for all costs from the point of delivery, including import customs clearance, duties and taxes. Can be used for all modes of transport.

DAP (Delivered at Place)

Very similar terms to DAT, with the difference that the buyer is responsible for unloading the goods at the named place of delivery. Buyer assumes responsibility from the point of unloading the goods, including import customs clearance, duties and taxes. Can be used for all modes of transport.

DDP (Delivered Duty Paid)

DDP terms indicate that the seller is responsible for carriage and delivery to a named place, including clearing for import and all applicable taxes and duties. Can be used for all modes of transport. They maximise cost and risk for a seller and minimise them for the buyer. The buyer’s responsibility for the goods begins when they receive them for unloading at destination. Can be used for all modes of transport.

EXW (Ex Works)

EXW terms indicate that the buyer is responsible for collecting the goods from the seller and accepts all onward arrangements, including associated costs, risks and liabilities.

FAS (Free Alongside Ship)

FAS terms require the seller to place the goods alongside the carrier vessel at the port of export, with seller responsibility for export customs clearance and risk and cost up to that point. The buyer takes responsibility for the goods from loading onto the vessel onwards.

FCA (Free Carrier)

FCA terms indicate that the seller is responsible for the goods, including costs, up to delivery to the buyer’s chosen carrier at a named location – often a terminal or transport hub or forwarder’s warehouse. The seller is responsible for export clearance, after which the responsibility transfers to the buyer.

If the named location is the seller’s place of business, then they are responsible for the loading of the goods. At all other named locations, the buyer is responsible for loading.

FOB (Free On Board)

FOB terms indicate that the seller and the buyer have relatively equal responsibility for all costs, risks and liabilities associated with transporting the goods. The seller is responsible up to the arrival for boarding the ship, including charges at the loading port. The buyer is responsible from loading onwards until the goods reach their final destination. FOB is usually the recommended option for importers and buyers, as it allows greater control over costs.